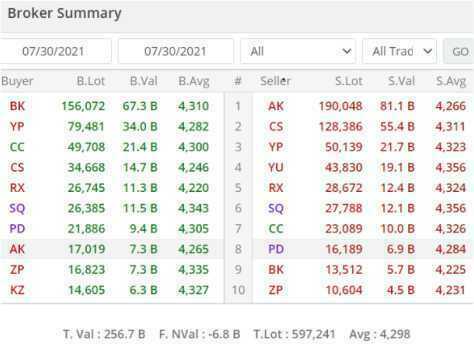

When it comes to investing in the stock market, making informed decisions is crucial. This is where a broker summary and analysis comes in handy. In this article, we will discuss what broker summary is, its significance, and three ways to read and interpret it.

What is Meant by Broker Summary?

A broker summary is a report that provides an overview of a particular stock or security, typically issued by a brokerage firm. It contains key information such as company background, financial statements, market trends, and analyst recommendations. Broker summaries are often used by investors to gain insight into the potential risks and rewards of a particular investment.

Significance of Knowing Broker Summary

Knowing how to read and interpret a broker summary is important for investors as it helps them make informed decisions about their investments. It provides a comprehensive view of a company’s financial health, including its strengths, weaknesses, opportunities, and threats. This information can be used to assess a company’s future growth potential, as well as its ability to generate profits and pay dividends.

How to Read Broker Summary

Here are three ways to read and interpret a broker summary:

- Company Overview: The first section of a broker summary usually provides a brief overview of the company. This section typically includes information such as the company’s history, products and services, and key executives. This information can help investors understand the company’s background and its place within the market.

- Financial Analysis: The financial analysis section of a broker summary is perhaps the most important. It typically includes the company’s financial statements, such as its income statement, balance sheet, and cash flow statement. These statements provide valuable information about a company’s profitability, liquidity, and solvency.

- Analyst Recommendations: The final section of a broker summary often includes analyst recommendations. These are opinions provided by analysts who cover the company and can be helpful in understanding the company’s future prospects. Analyst recommendations may include ratings such as buy, hold, or sell, as well as target prices.

Broker Summary Analysis

Analyzing a broker summary requires investors to consider a range of factors. For example, investors should look at a company’s financial statements and evaluate its revenue growth, profitability, debt levels, and cash flow. They should also consider the company’s competitive landscape and market trends, as well as any regulatory or legal risks that may impact the company’s operations.

In conclusion, a broker summary and analysis is an important tool for investors looking to make informed decisions about their investments. By understanding how to read and interpret a broker summary, investors can gain valuable insights into a company’s financial health and growth potential. With this information, they can make better-informed decisions about which companies to invest in and which to avoid.